Village Bank

September to December are the hardest months for people in this district; rice stocks are exhausted, major festivals have accrued many expenses, and illness prevents many people from working and earning. Many people are tempted to go to money lenders, who tend to have extravagent interest rates, and this can lead to the ruin of the family; their inability to meet the moneylenders’ huge interest rates can result in selling the family home or land.

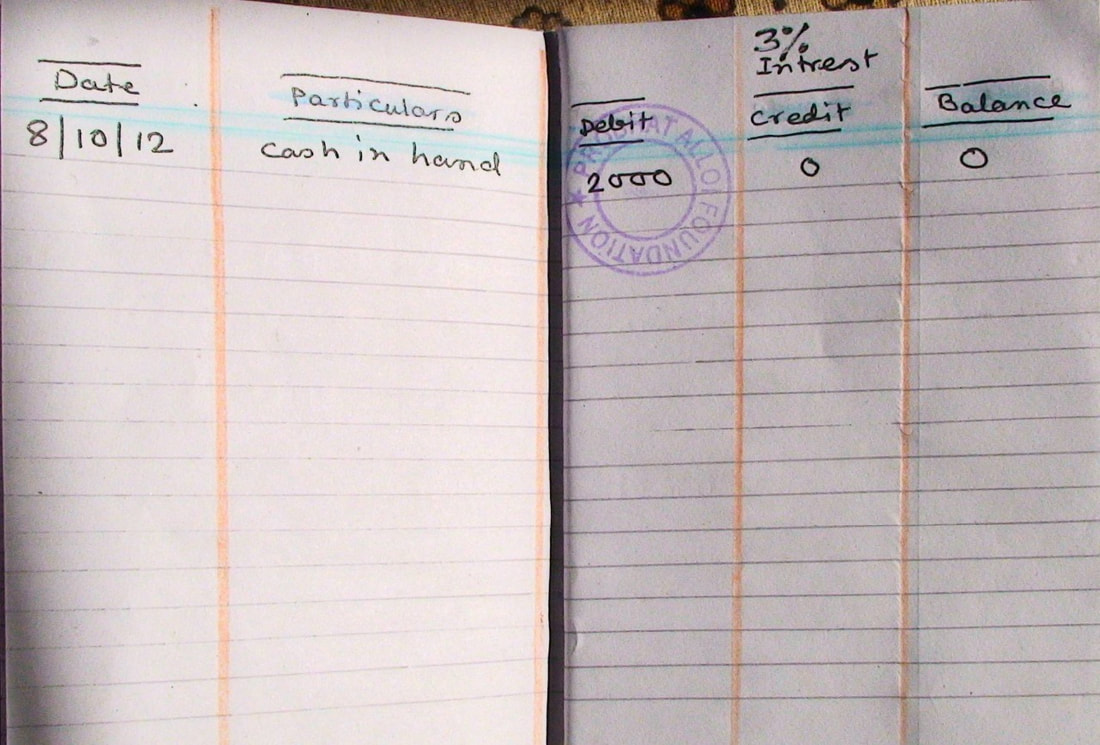

For this reason, Prabhat Alloi Foundation started up a village bank in October 2012. The loans were for the poorest of the poor: lendees had one year to repay, and the interest rate was set at 1% per year. This did not cover costs, and at that rate was dependent on continued support from sponsorship. We continued to review the interest rate charged. The bank team visited applicants in their homes to assess their needs and eligibility, and provide a counselling service explaining the loan system and the benefits of making regular repayments. The minimum loan given was 500 Rupees ($10) and the maximum 2000 ($40). Loans were taken out for purposes of starting small businesses like breeding goats, chickens or ducks, selling vegetables or gardening; buying seeds; employing agricultural labourers; paying for marriages or funerals; or covering health costs or paying for emergency services.

The bank worked very well for the people, making a big difference by providing a new level of security and opportunity for many people in this region. However, the management team found it very difficult to collect the minimal payments from those who had borrowed money. It has now closed down, but remains as a possibility for future exploration if the team in future finds they can manage it.